A change of format this month. Let’s start with some key market indicators to provide everyone with a quick executive summary before providing some commentary about the numbers.

Year to date (January through April) the Golf specialist market has seen the following value changes versus 2022:

- Overall Market +1.6%

- On-course -1.2%Off-course +5.7%

- On and off-course split: 56.7% to 43.3%

- Top performing category = Apparel (Shirts, Tops, Bottoms and Outerwear) +13.8%

- Women Tops are the highest performer +21.1%

- Worst category was ‘Other’ (Trolleys and Distance Devices) – 8.8%

- Trolleys are the worst performer – 17.2%

- Consumables are running at +7.5% year to date

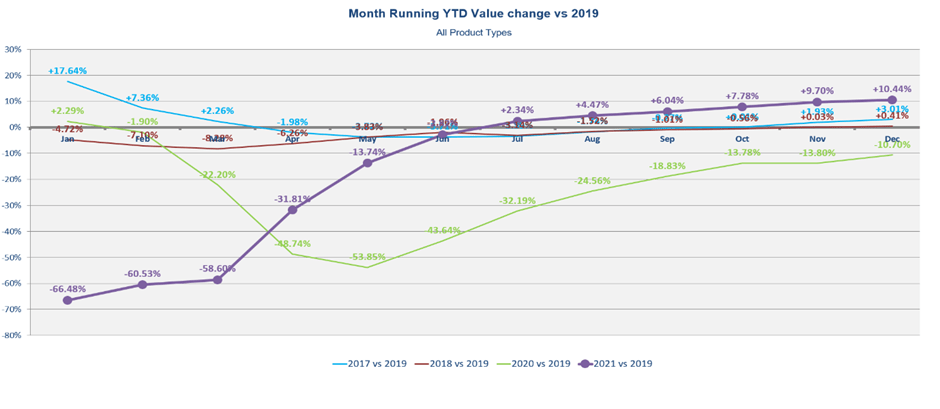

For a longer term context we will also compare Year to Date value position versus 2019.

- Overall market value +19%

- On-course +14%

- Off-course +26.3%

- Top performing category = Clubs (Irons, Woods, Putters and Wedges) +29%

Initial thoughts

At the end of last year, my gut feeling was that we should have a similar year to 2022. If the weather was good, then the market could be up. However, if the economic woes compounded, it might be a bit down.

I expected some of the spend profiles to change: with the Apparel categories gaining and some hardware categories falling. So far, that appears to be about right. The weather during the first quarter of the year wasn’t great and March was particularly wet. However, the other months have been reasonable and in the main, it has been warmer than average.

We have lost approximately three additional golf days to rain – mainly in March. Play appears to have been similar when compared to last year. This has been supported by consumable sales, with Ball units down 3% on-course but gloves up 5%.

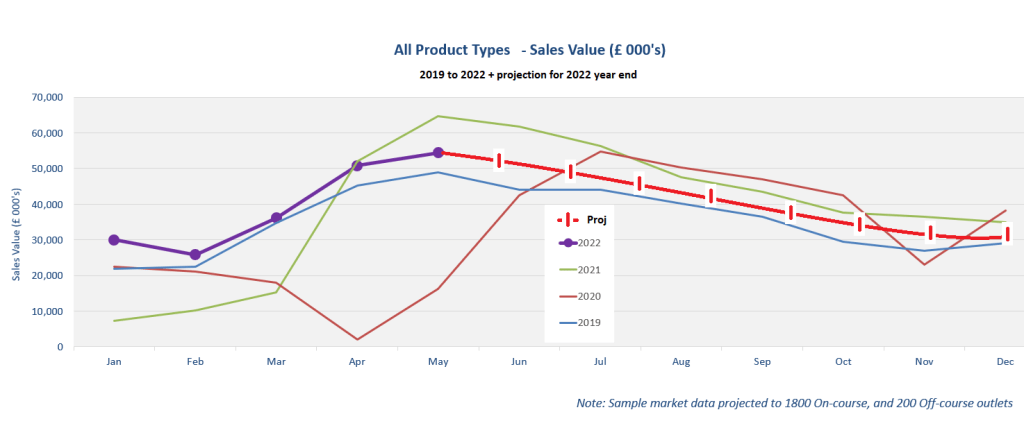

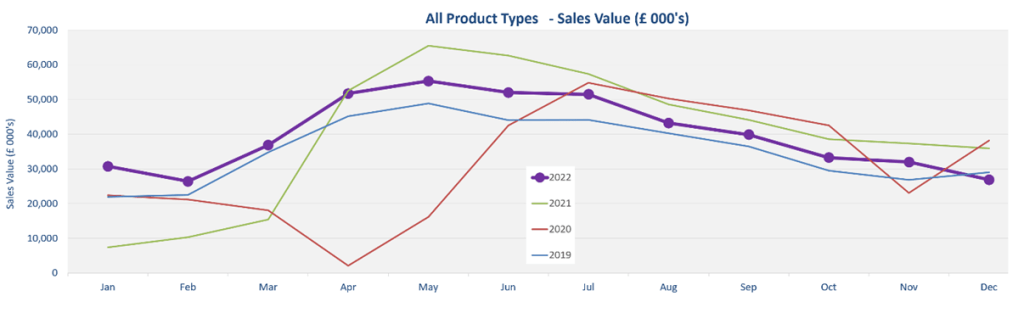

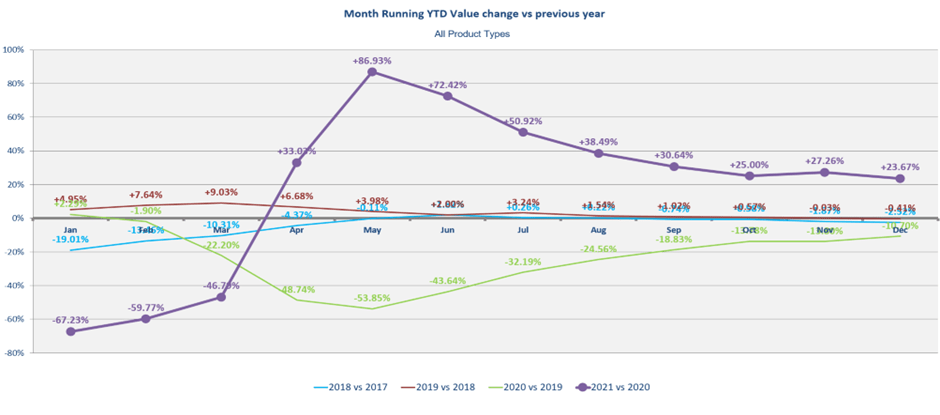

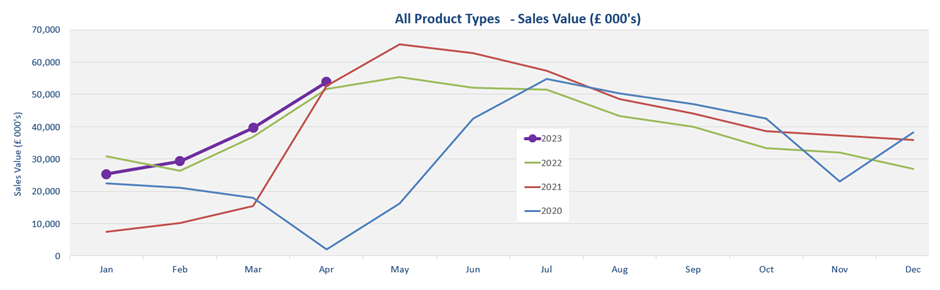

So the general synopsis for 2023 is that it is going well and, if not for comparisons with January 2022, it started with a record month. January was down on 2022 but this was to be expected. Last year was a freak month seeing some strange numbers due to stock availability and order build up. As we moved in to the subsequent months, they were all higher than 2022.

Looking at the monthly rolling change, we can see that year to date value has taken a couple of months to catch up. Since March the overall numbers have been ahead of last year. This is a good indicator as the general direction in April is usually followed for the rest of the year.

Winners and losers

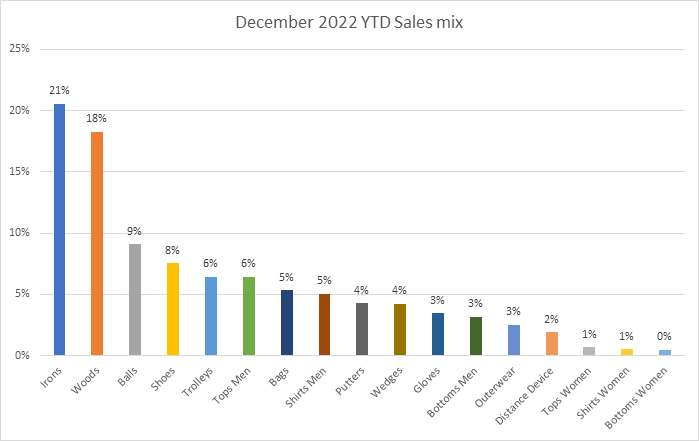

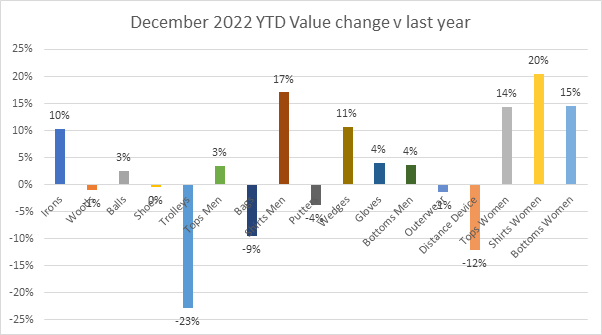

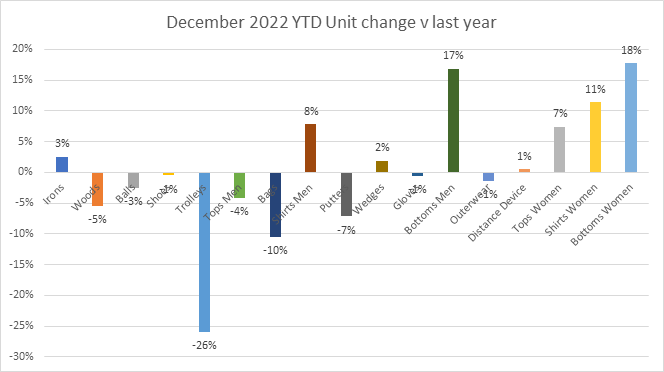

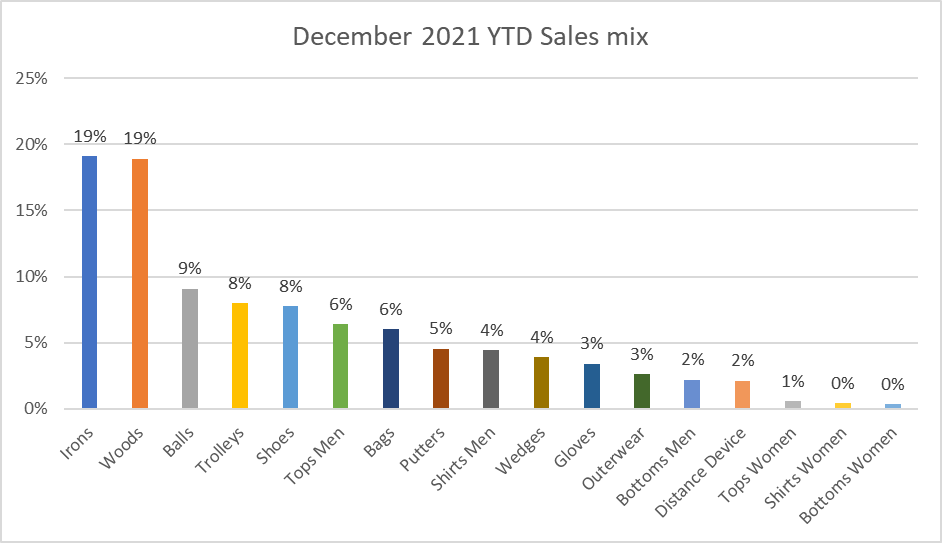

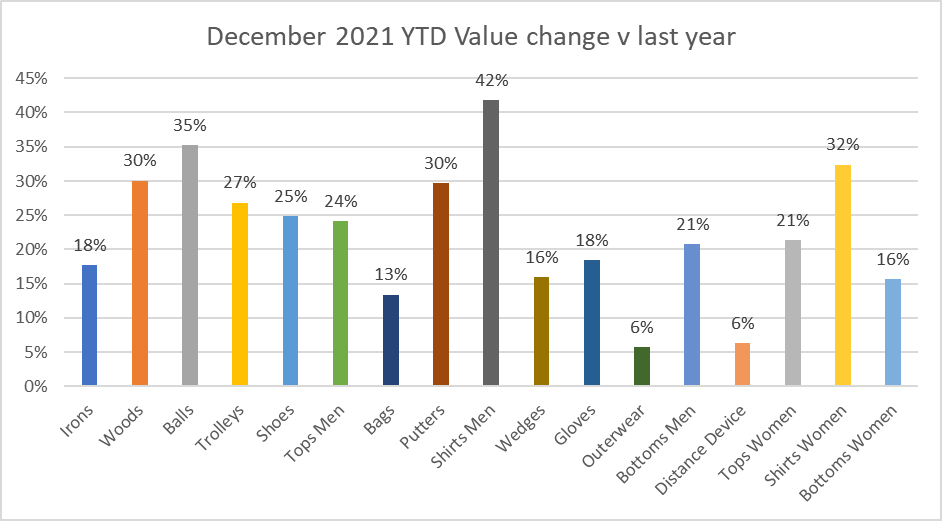

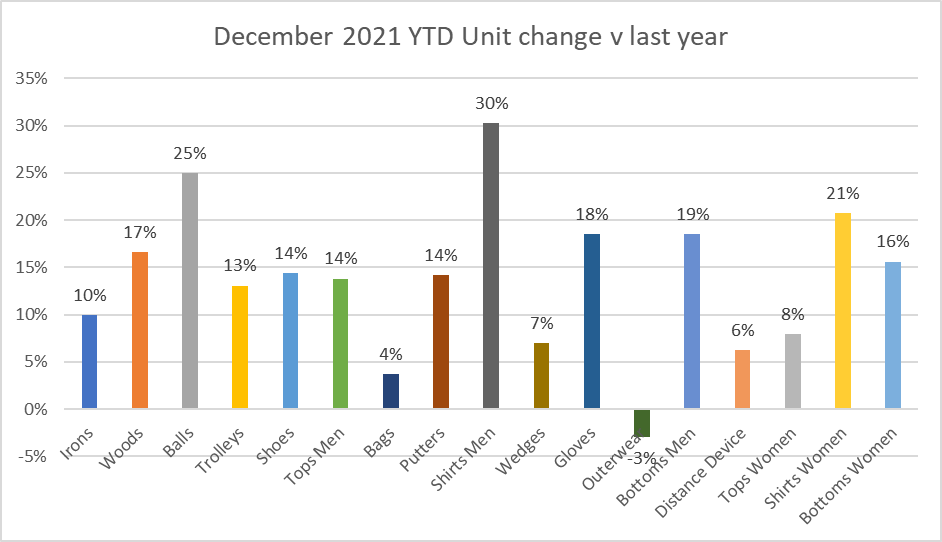

As is often the case, while general spend is up, it doesn’t apply to all categories.

Clubs have done incredibly well but, year to date, only Woods and Wedges are up. Irons and, even more surprisingly, Putters, are down in value. In fact, Putters are currently sitting nearly 5% down compared to the same period in 2019. There seems to be an issue with Putters and they are not grabbing the attention of golfers. Woods, on the other hand, are 34.8% up on 2019. The buzz around new products seems to be creating lots of consumer demand.

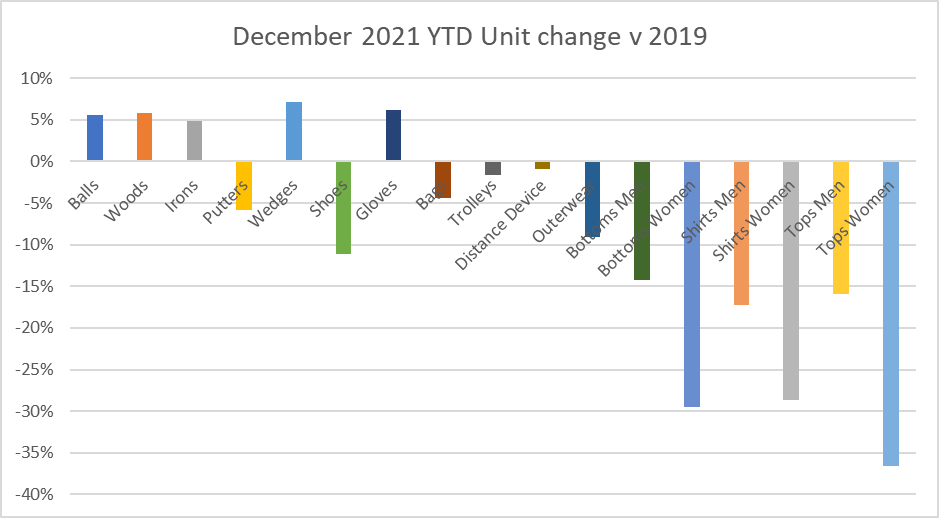

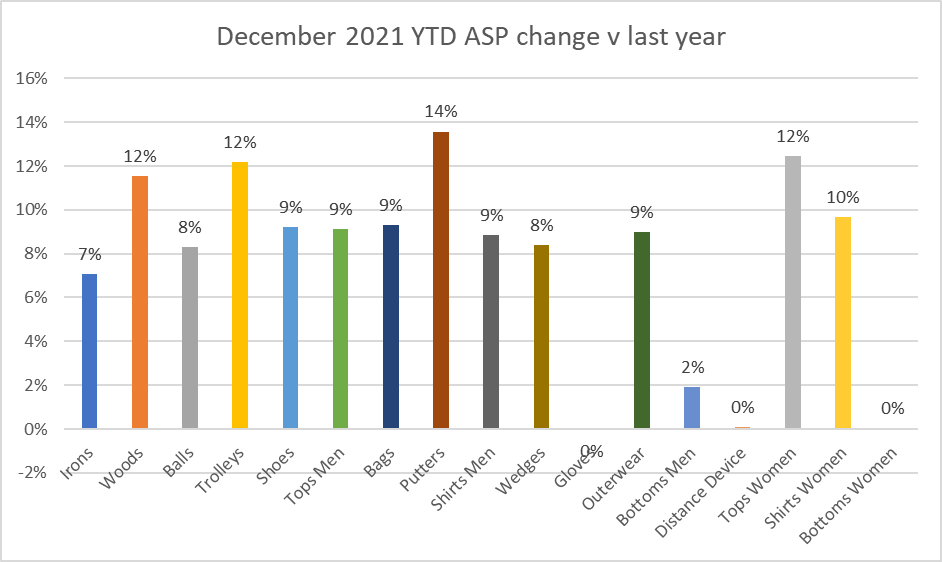

On the down side, we see a couple of interesting things happening. First is that the Trolleys category is down in value on both 2022 (-17.2%) and 2019 (-5.7%). This category was very hot in 2021 and looked like it was going to continue in 2022. It seems to have run out of steam. In units, this category is down 25% on 2022 and 35% on 2019. However, Average Selling Price (ASP) has seen the biggest growth in any category – with a 11% increase v 2022 which is an amazing 45% increase v 2019.

Perhaps we have hit the limits on what consumers are willing to pay.

The second really interesting thing is happening in Apparel. With the huge increase in women’s participation of golf during the pandemic, I had expected this to positively affect Women’s Apparel sales. Year to date two out of three categories are up in value versus 2022 but all three women’s categories are down versus 2019. If there are now lots more women golfers, this has not translated into spend through the specialist golf channel. And, if that’s the case, where are women buying their golf clothing?

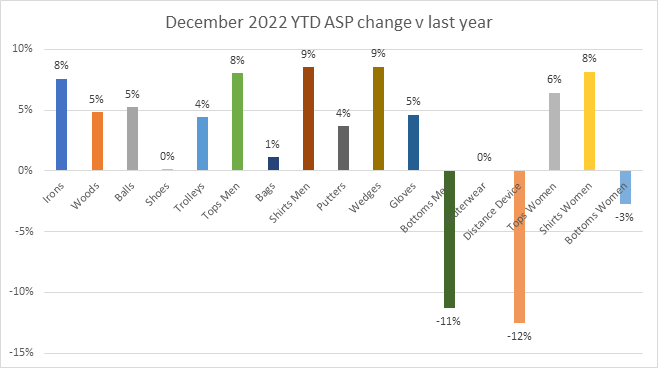

Inflation effects

Moving on to the topic of inflation and price increases, it would be easy to assume that all prices are up. However, year to date, only six of 17 categories are seeing higher than average sales prices than last year. The biggest increase is Trolleys at 11.6%. Irons are pretty much flat at 0.6% and categories such as Shoes, Putters and Wedges have all seen drops in ASP (as much as 7% for Shoes).

Nearly all clothing is down as well, with the only exception being Men’s Bottoms. Looking at the long term, prices are definitely up – with 14 out of 17 categories seeing an increase since 2019. While Trolleys lead the way up an amazing 45%, clubs are next averaging out at a 23% increase.

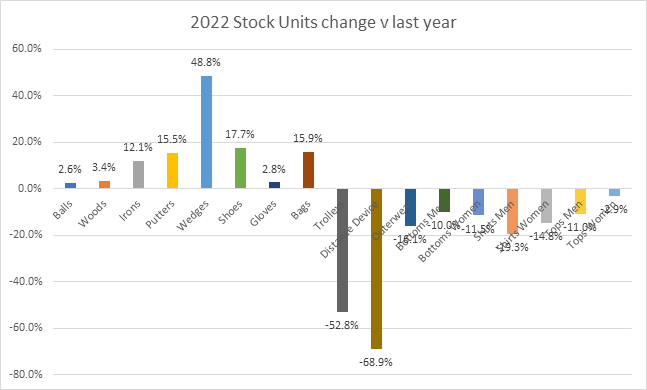

Inventory

Inventory has been the subject of much discussion and concern for months now.

It would be fair to say that at the end of April 2023, there was a lot of product in stock compared to 2022. Looking at units in stock, clothing has seen a massive jump.

Shoes and Wedges are both up over 45%.

Only Trolleys and Distance Devices have seen any reduction.

Interestingly, Bags were the big concern last year and now they are sitting at just 6.5% – up on 2022.

If we take a longer view, nine out of 17 categories are up versus 2019.

With a longer perspective, things don’t look that bad. There are a few key areas that seem to have a lot more stock – Balls and Wedges are up 27% and 40% respectively.

Units however are only one part of the story and this is where some caution needs to be observed. The current retail value of stock (units multiplied by current ASP) is up 23% versus 2022 and 27% versus 2019. Assuming cost prices have moved in a similar direction to street prices, some retailers might be feeling a little tight on cash. While this isn’t a problem at the start of the peak season, it is something we will need to monitor as the season progresses. It might also indicate that there will be significantly more promotional activity this year as retailers try and liquidate their stock later in the season.

Final thoughts

Generally, I am positive about the season and so are most of the brands and retailers that I have talked to. There is some concern about the impacts of price increases but generally this is no worse than last year. There is also concern on stock. While there are no major concerns at this time in the year, we will keep an eye on both of these as the season develops.

The general sales trend is encouraging and, with numbers up on last year, it shows that consumers are still spending on golf. The growth trend is consistent and that is the most comforting observation so far. If you look at the graph below, you’ll see 2023 is tracking 2022 at a consistent but higher position.

With a fair wind I would expect this to continue at least for the next couple of months. I am sure as the stock situation works itself out we will see some promotion later in the year.